Making the Corporate Alternative Minimum Tax Less Silly

The House reconciliation bill includes numerous changes to the tax code: good, bad, and ugly. However, the new corporate alternative minimum tax, or CAMT, goes largely untouched.

4 min read

The House reconciliation bill includes numerous changes to the tax code: good, bad, and ugly. However, the new corporate alternative minimum tax, or CAMT, goes largely untouched.

4 min read

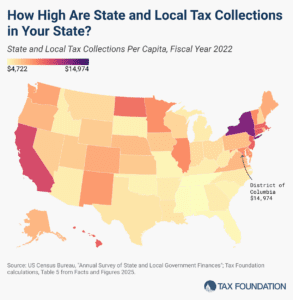

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

The Trump administration advocates an “energy dominance” agenda to boost US energy production and lower costs. Its tariff agenda runs directly counter to it.

5 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

While fixing infrastructure funding has not been a focus of the tax expiration debate, it would be a smart way to pay for at least a small portion of the expiring tax cuts. In recent years, highway funding has exceeded highway revenues, and the introduction of electric vehicles has made the gas tax increasingly obsolete.

7 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

Even though energy prices have declined from their recent peak, the United Kingdom is one of the few countries in Europe continuing to rely on windfall profits taxes to support households with the rising cost of living.

4 min read

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

The stakes for next year’s expiring tax provisions are quite high. If Congress does nothing, then 62 percent of households will see their taxes go up in January of 2026.

Rather than pursuing temporary policies, policymakers should implement long-term, pro-growth tax reforms that stimulate economic activity and incentivize energy diversification by supporting private investment through full expensing.

19 min read

If lawmakers are convinced that new revenues must be part of any long-term effort to solve the budget crisis or offset the cost of extending the TCJA, they must choose the least harmful ways of raising new revenues or else risk undermining their efforts by slowing economic growth.

7 min read

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

3 min read

By 2034, the gas tax and other car-related excise taxes are projected to raise less than half of the Highway Trust Fund’s outlays. While broader tax and spending reforms are necessary for overall deficit reduction, improving transportation funding would be a crucial step forward.

34 min read

Though gas taxes are intended to serve as user fees and pollution deterrents, they vary widely across states. How does your state’s burden compare?

4 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

Neutral tax codes don’t play favorites or try to influence personal or business decisions but stick to what they’re best at – raising sufficient revenue through low rates and a broad base.

Gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

8 min read