Time (or Buying American) Won’t Erase the Economic Harm of Higher Tariffs

Contrary to the president’s promises, the tariffs will cause short-term pain and long-term pain, no matter the ways people and businesses change their behavior.

5 min read

Contrary to the president’s promises, the tariffs will cause short-term pain and long-term pain, no matter the ways people and businesses change their behavior.

5 min read

Tax legislation in 2025 may have good reason to address international corporate income taxes, because of scheduled changes slated to go into effect or because of international developments like the Pillar Two agreement.

63 min read

In a perilous economic and fiscal environment, with instability created by Trump’s trade war and publicly held debt on track to surpass the highest levels ever recorded within five years, a lot rides on how Republicans navigate tax and spending reforms in reconciliation.

6 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

A recent proposal in Minnesota exempting certain nonresident workers from having to file and pay income taxes would reduce compliance costs for business travelers and their employers at limited cost to the state.

4 min read

With property tax bills on the rise, homeowners are searching for answers—and some even want to abolish the tax altogether. In this episode, we break down why property taxes are increasing, common but flawed solutions, and why the property tax remains an economically efficient revenue source.

While capping C-SALT has superficial appeal in perceived parity with personal limits, it rests on flawed assumptions about the nature of individual and corporate income taxes.

7 min read

While evaluating new estate tax bills this legislative session, Oregon legislators should consider the state’s competitive tax landscape and interstate migration patterns.

4 min read

Permanently extending the Tax Cuts and Jobs Act would boost long-run economic output by 1.1 percent, the capital stock by 0.7 percent, wages by 0.5 percent, and hours worked by 847,000 full-time equivalent jobs.

6 min read

The next government needs to prioritize measures to improve Germany’s competitiveness as an investment location.

7 min read

In this episode, Adam Hoffer, Director of Excise Tax Policy at the Tax Foundation, joins Kyle Hulehan to unpack the intricacies of sports betting tax policy during one of the biggest betting events of the year—Super Bowl 59.

As Republicans look for ways to offset the budgetary cost of extending the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially enacting other tax cuts, the latest estimates indicate several trillion dollars could be raised by reducing tax credits and other preferences in the tax code.

5 min read

Are tariffs making everything more expensive? With Trump’s new tariff plans hitting $1.1 trillion in imports—far more than his first term—prices could rise for businesses and consumers alike.

In a recent survey regarding companies’ barriers to conducting business in the EU single market, VAT ranked first. Policymakers should invest in reforming VAT systems to close both compliance and policy gaps in ways that improve the overall efficiency of their tax systems.

7 min read

As the third-largest economy in the world, with an influential voice within EU policymaking, and the United States among its most important trading partners, Germany’s next government will play a particularly important role in deciding the direction of European tax, trade, and transatlantic policy.

6 min read

In a recent speech at the Davos Economic Forum, European Commission President Ursula von der Leyen announced plans to create a single set of rules for corporate law, insolvency, labor law, and taxation, under which companies could seamlessly operate across the European Single Market.

7 min read

Despite stark competitiveness differences, both New Jersey and Utah share a common goal this legislative session: reforming economic nexus rules that require out-of-state sellers and marketplace facilitators to collect and remit state sales taxes.

4 min read

What will the future of tax policy look like? In this episode, we dive into the critical challenges and opportunities looming on the horizon, especially with major tax cuts set to expire, which could increase taxes for 62 percent of filers.

This week, the incoming Trump administration issued a day-one executive order on the global minimum tax agreement known as Pillar Two, which seeks to ensure multinational corporations pay at least 15 percent in income tax.

6 min read

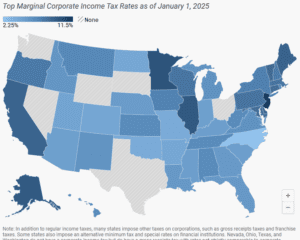

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read