Featured Articles

All Related Articles

The Italian DST Remix

6 min read

Italy Can Pay for a Flat Tax

4 min read

Reliance on Consumption Taxes in Europe

2 min read

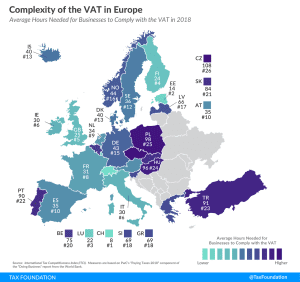

Complexity of the VAT in Europe

2 min read

Tax Foundation Response to OECD Public Consultation Document: Addressing the Tax Challenges of the Digitalization of the Economy

Though the challenges to international tax policy are many, the OECD has a chance to work toward a system that creates fewer distortions and negative economic effects than the current one. However, given the policies on the table, it will certainly take quite an effort to avoid further complexity of international tax rules that creates challenges to global trade and economic prosperity.

VAT Rates in Europe, 2019

4 min read

Opportunities for Pro-Growth Tax Reform in Austria

Austria needs to pursue comprehensive business and individual tax reform if it wants to remain competitive. Our new guide explores several ways the Austrian government can achieve a simpler, more pro-growth tax code.

10 min read

EU Likely to Pause on Digital Tax Push

2 min read