Analyzing the Kansas Senate’s Proposed Tax Changes

As Kansas legislators consider additional tax policy changes this legislative session, they should prioritize economic growth and a structurally sound tax code.

7 min read

As Kansas legislators consider additional tax policy changes this legislative session, they should prioritize economic growth and a structurally sound tax code.

7 min read

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

When peeling back layers of the JCT report, it becomes clear that many tax expenditures are not “loopholes” or benefits for narrow special interests, but important structural elements of the tax code.

6 min read

The year-end omnibus federal spending package makes a number of reforms to retirement savings accounts.

3 min read

Two weeks after the 2022 midterm elections, it’s becoming clearer where tax policy may be headed for the rest of the year and into 2023. In the short term, Congress must deal with tax extenders and expiring business tax provisions that may undermine the economy.

5 min read

The Social Security Administration (SSA) announced the cost-of-living adjustment for Social Security payments based on inflation over the previous year. This has brought renewed attention to how the tax code treats Social Security benefits, which can be a confusing subject for taxpayers.

4 min read

The Inflation Reduction Act calls for a new 1 percent excise tax on stock buybacks, the argument being it would be better for the economy if firms invested their surplus cash in the business, rather than returning this value to shareholders.

3 min read

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

The proposals share a common goal of improving incentives for households to save during a time when inflation is impacting their finances.

3 min read

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

The Build Back Better Act would raise taxes to pay for social spending programs. But the design of some of the tax increases may end up hurting private pensions, among other problems.

6 min read

While falling short of comprehensively reforming the complex U.S. retirement savings system, House and Senate lawmakers have proposed bipartisan bills to help simplify and expand access to retirement savings accounts to more workers.

4 min read

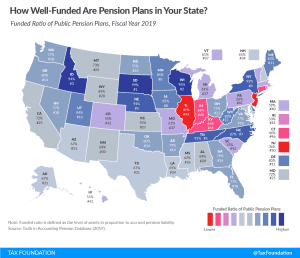

Although most states are on solid financial footing following the coronavirus crisis, pension liabilities are a deep-seated problem that long predates the pandemic.

2 min readTo encourage private retirement savings, OECD countries commonly provide tax-preferred retirement accounts. However, in many countries, including the United States, the system of tax-preferred retirement accounts is complex, which may deter savers from using such accounts—and potentially lower overall savings.

21 min read

States compete with each other in a variety of ways, including in attracting (and retaining) residents. Sustained periods of inbound migration lead to (and reflect) greater economic output and growth. Prolonged periods of net outbound migration, however, can strain state coffers, contributing to revenue declines as economic activity and tax revenue follow individuals out of state.

4 min read

President Biden and Congress should concentrate on areas of common ground, finding incremental places to improve the tax code. A bipartisan bill recently introduced to help retirement savings is a good model for what incremental reform may look like.

4 min read

The Securing a Strong Retirement Act seeks to encourage retirement savings by simplifying and expanding the use of different types of retirement accounts.

3 min read

One of Biden’s tax proposals that has gotten little attention is a change that would shift the benefits of tax deferral in traditional retirement accounts toward lower- and middle-income earners. The plan would reduce the tax benefit for those earning above $80,250 but under $400,000, violating Biden’s tax pledge to not raise taxes on earners below the $400,000 threshold.

5 min read