All Blog Posts

Fiscal Forum: Future of the EU Tax Mix

Tax Foundation Europe’s Sean Bray had the opportunity to interview Professor of International Taxation at the University of Mannheim Business School, Christoph Spengel, about the future of the EU tax mix.

15 min read

The Fiscal Consequences of Increased German Spending

Without aligning fiscal discipline with pro-growth tax policies, Germany and the EU risk high deficits, mounting debt, and sustained inflation.

5 min read

Fiscal Forum: Tax Foundation Europe Interview with Italian Vice-Minister Maurizio Leo

Daniel Bunn had the opportunity to interview the Vice-Minister for Economy and Finance of Italy, Maurizio Leo, about the tax policy priorities of the Italian government. The conversation shows a commitment to reforming rules that create legal uncertainty and support competitiveness.

5 min read

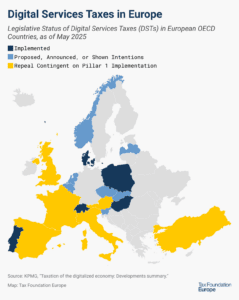

Discrimination vs. Neutrality: A Case Study in the Middle of a Trade War

Policymakers should aim for neutral tax policies that support stable revenues like VATs and avoid inviting trade conflicts with discriminatory and economically harmful policies like DSTs.

6 min read

Effects of the Federal Constitutional Court’s Judgment on Germany’s Solidarity Surtax

Surtaxes such as Germany’s solidarity surtax run counter to the principles of simplicity and transparency of the tax system because they impose an additional layer of tax on taxpayers and create a more complex tax structure that often obscures the actual tax burden.

4 min read

Observing the German Election: Tax Policy for Economic Growth

The next government needs to prioritize measures to improve Germany’s competitiveness as an investment location.

7 min read

Reducing Germany’s Corporate Tax Rate to 25 Percent

Ahead of Germany’s federal election, the country’s economy remains stuck in a prolonged recession, with GDP stagnating for the past two years and failing to surpass its pre-pandemic level.

6 min read

The European VAT is Not a Discriminatory Tax Against US Exports

The Trump administration appears to be moving in a “reciprocal” policy direction despite the significant negative economic consequences for American consumers of across-the-board tariffs on goods coming into the US. However, the EU’s VAT system should not be used as a justification for retaliatory tariffs.

6 min read

Simplifying Germany’s Income Tax System: A Path Toward Fairness and Efficiency

While many Scandinavians get mailed comprehensive pre-filled tax returns and only have to check whether they are correct, the average German taxpayer spends 9 to 10 hours and over €100 filing their tax return.

7 min read

The EU’s Questionable VAT Policy

In a recent survey regarding companies’ barriers to conducting business in the EU single market, VAT ranked first. Policymakers should invest in reforming VAT systems to close both compliance and policy gaps in ways that improve the overall efficiency of their tax systems.

7 min read

Transatlantic Tensions: What the German Election Could Mean for International Tax & Trade Policy

As the third-largest economy in the world, with an influential voice within EU policymaking, and the United States among its most important trading partners, Germany’s next government will play a particularly important role in deciding the direction of European tax, trade, and transatlantic policy.

6 min read

Distributed Profits Taxation Would Be a Good Role Model for the EU’s 28th Regime

In a recent speech at the Davos Economic Forum, European Commission President Ursula von der Leyen announced plans to create a single set of rules for corporate law, insolvency, labor law, and taxation, under which companies could seamlessly operate across the European Single Market.

7 min read

Spain’s Poorly Designed Tax Policy Hurts Its Competitiveness

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

Are Windfall Taxes Becoming the New Normal in the UK?

Even though energy prices have declined from their recent peak, the United Kingdom is one of the few countries in Europe continuing to rely on windfall profits taxes to support households with the rising cost of living.

4 min read

Wartime Taxes Are Waging War on Sound Policy Choices

Spain’s central government is considering making its windfall taxes on energy companies and the banking sector permanent.

6 min read

What Does Moving Toward a More Competitive EU Tax System Mean?

As the geopolitical scene continues to change, policymakers in Europe should focus on lowering effective marginal tax rates to drive much-needed investment and long-term economic growth.

6 min read

The French Budget: Moving from Public Debate to Principled Solutions

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read

Tax Files under New Council of EU Presidency: Hungary

As Hungary takes over the six-month rotating presidency of the Council of the European Union in the aftermath of the European elections, the relationship between tax policy and Europe’s competitiveness will be closely linked.

6 min read

Understanding Full Expensing in the United Kingdom

Given the positive contribution of full expensing to economic growth and that the UK already incurred the peak-year costs due to the existing policy, it is imperative to maintain it permanently.

5 min read

The European Union’s ViDA Proposal: Ignoring Principles Does Not Make Tax Policy Fairer

Adopting tax policy based on sound principles like neutrality rather than political expediency is essential for the European Union’s fiscal future.

5 min read