Top Personal Income Tax Rates in Europe, 2025

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) levy the highest top personal income tax rates in Europe.

4 min readProviding journalists, taxpayers, and policymakers with the latest data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission.

As a nonpartisan, educational organization, the Tax Foundation has earned a reputation for independence and credibility. Our global tax policy team regularly provides accessible, data-driven insights, including a survey of corporate tax rates around the world, from sources such as the Organisation for Economic Co-Operation and Development (OECD), the European Commission, and others.

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) levy the highest top personal income tax rates in Europe.

4 min read

More than 175 countries worldwide—including all major European countries—levy a value-added tax (VAT) on goods and services. EU Member States’ VAT rates vary across countries, though they’re somewhat harmonized by the EU.

5 min read

Some European countries have raised their statutory corporate rates over the past year, including Czechia, Estonia, Iceland, Lithuania, and Slovenia.

3 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

The worldwide average statutory corporate tax rate has consistently decreased since 1980 but has leveled off in recent years. In the US, the 2017 Tax Cuts and Jobs Act brought the country’s statutory corporate income tax rate from the fourth highest in the world closer to the middle of the distribution.

18 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

33 min read

To prevent businesses from minimizing their tax liability by taking advantage of cross-country differences, countries have implemented various anti-tax avoidance measures, such as the so-called Controlled Foreign Corporation (CFC) rules.

5 min read

To reduce tax compliance and administrative costs, most countries have VAT exemption thresholds: If a business is below a certain annual revenue threshold, it is not required to participate in the VAT system.

2 min read

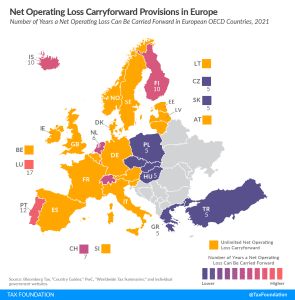

Many companies have investment projects with different risk profiles and operate in industries that fluctuate greatly with the business cycle. Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

7 min read

During the COVID-19 pandemic, several OECD countries temporarily expanded their NOL carrybacks and carryforwards to provide relief to illiquid but otherwise solvent businesses. These policies should be made permanent and, where necessary, expanded.

21 min read

As economic activity resumes and the task of accounting for the deficits incurred in navigating the crisis of the past year becomes the focus of fiscal policy deliberations, a greater reliance on VAT could be an important tool in ensuring fiscal stability going forward. Countries should use this as an opportunity to improve VAT systems by re-examining carveouts in the form of exemptions and reduced rates.

2 min read

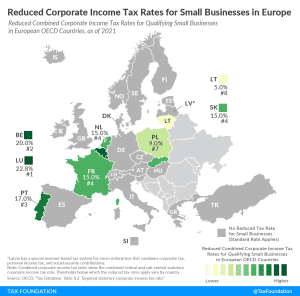

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses. Out of 27 European OECD countries covered in today’s map, eight levy a reduced corporate tax rate on businesses that have revenues or profits below a certain threshold.

3 min read