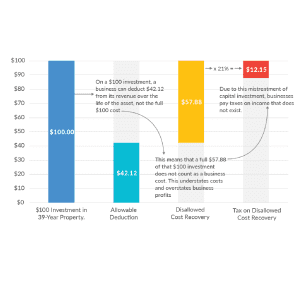

Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

While tax rates matter to businesses, so too does the measure of income to which those tax rates apply. The corporate income tax is a tax on profits, normally defined as revenue minus costs. However, under the current tax code, businesses are unable to deduct the full cost of certain expenses—their capital investments—meaning the tax code is not neutral and actually increases the cost of investment.

3 min read